Imagine this scenario:

- You switch your health insurance coverage to a new carrier.

- Premiums for the new plan are about the same or even less than you are paying now.

- Your employee’s co-payments, deductibles and doctor networks are comparable to what they previously had.

- At the end of the plan year, if employee claims are lower than expected, your company will be entitled to a refund of a percentage of premiums paid, after renewal.

- If claims are unusually high, the insurance company pays those claims, you just don’t get a refund.

So you either win, or you don’t lose.

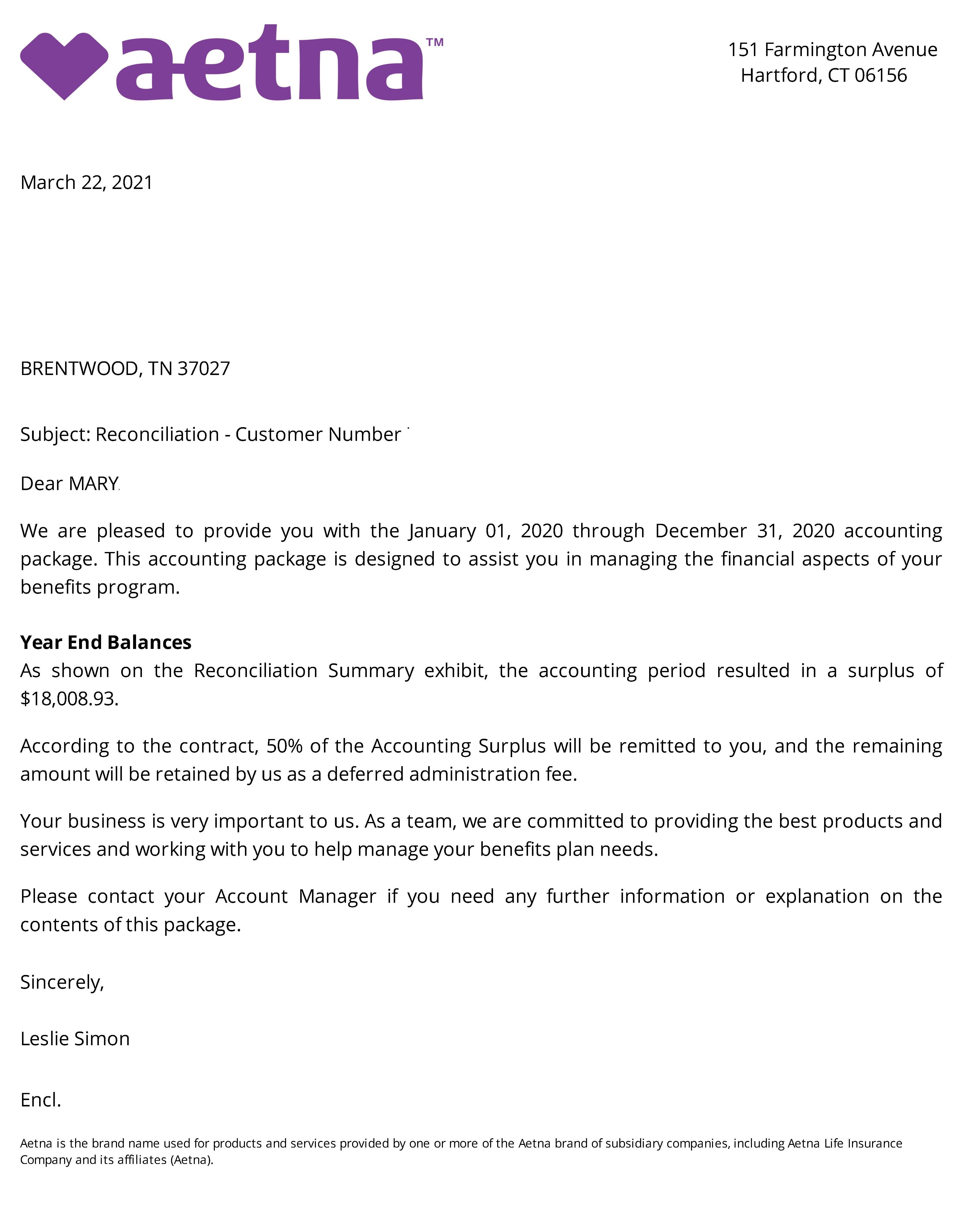

Last year, about half of my groups received premium refunds. Here is an email from one of my groups:

Hi, Rick. We received a letter from Aetna to let us know that our account created a surplus of around $12,000 for the last plan year. We will receive half of the amount. We are pleased with this result and want to thank you for setting us up in this type of plan.

Want to see if your group can qualify? Click here to schedule your 15 Minute Strategy Call now.